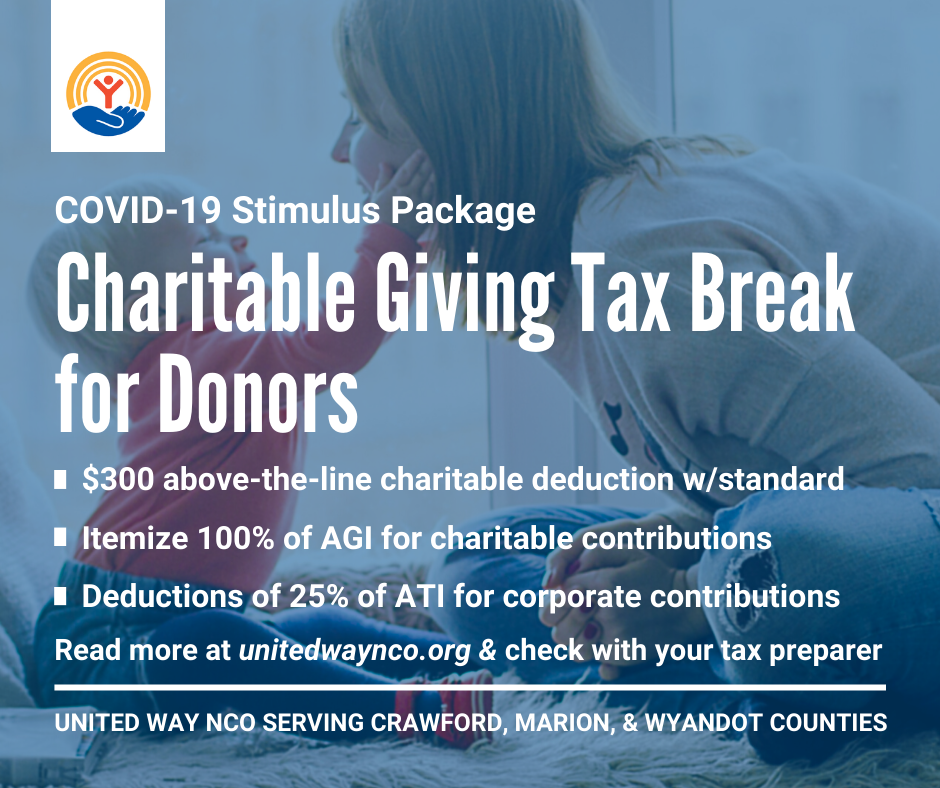

Federal CARES (Coronavirus Aid, Relief and Economic Security) Act Includes Charitable Giving Tax Break for Donors

The CARES Act includes added financial incentive for community members who want to make donations in support of local efforts to combat the near- and long-term effects of the pandemic on our community. A universal tax break for charitable donations was included in the stimulus package and will go into effect for the 2020 tax year.

- Donors who take the standard deduction may also take an “above-the-line” deduction for up to $300 in charitable donations given in 2020. This effectively allows a limited charitable deduction to taxpayers claiming the standard deduction. For example, if you take the standard deduction and give $300 to charity, you will get a $300 tax break in addition to the standard deduction.

- For donors who itemize deductions, the limit on charitable deductions – generally 60% of modified adjusted gross income – doesn’t apply to qualifying cash contributions to public charities in 2020; instead the CARES Act allows taxpayers to claim a tax deduction of up to 100% of your Adjusted Gross Income for contributions to qualifying charities.

- For corporate donors, the limitation on charitable deductions, which is generally 10% of modified taxable income, doesn’t apply to qualifying contributions made in 2020. The new law temporarily lifts the limit from 10% to 25% of modified taxable income for 2020 filings.

Please consult your accountant or tax preparer for more information about these changes, and how they can help you help others during the COVID-19 pandemic.

Learn more about United Way of North Central Ohio’s Community Relief Fund here: https://unitedwaynco.org/donate-now/.